How to Send Money to Someone in Another Country

Source:nerdwallet.com

Long gone are the days when you had to wait several days to send money abroad and had to rely on your high street bank. Today, there are countless dedicated international money transfer and currency exchange companies vying for your business, with some offering near-instant remits and great sign-up bonuses.

This guide will help you understand how you can send money abroad, but first, let’s go through a few key distinctions between high street/retail banks and dedicated global money transfer companies.

Retail Banks vs. Money Transfer Companies

Although dedicated money transfer companies have taken over the market in many countries, high street banks continue to play an important and sizeable role.

With regards to speed, you’re likely to find your local bank to be far slower at processing international money transfers than most dedicated transfer companies. Banks typically take 3-5 working days to process international payments, while some dedicated money transfer providers can facilitate such transfers in less than an hour.

Moving on to another very important factor for customers, retail banks, and dedicated money transfer companies typically have contrasting fee structures.

Banks usually charge a fixed fee on international transfers. In contrast, money companies typically charge their fees as a percentage of the amount sent, which makes them more cost-effective for relatively small transfers. At the same time, banks are cheaper for larger ones.

Finally, it is important to bear in mind that banks and most money remittance companies charge a spread on transfers that involve a currency exchange.

This spread charge is one that many customers are unaware of and essentially means your recipient gets less of the new currency than they would at the true mid-market exchange rate. A very select few money transfer companies don’t charge spreads and operate on a fully transparent fee model.

The Best Option For You

As previously mentioned, unless you’re making a large transfer, you are likely to be better off using a dedicated money remittance company to send funds abroad. However, this only narrows down the selection process a bit, as there are countless dedicated money companies out there.

When Deciding Which Option Is Best For You, Consider The Following:

What Are The Fees?

Fees vary quite a bit from company to company, both in terms of explicit fees (the percentage charged) and the spread. It is best if you can shop around in order to find the provider with the lowest fees for your specific transfer, as some companies’ fees vary depending on the countries involved.

Is The Provider Quoting Current Conversion Rates?

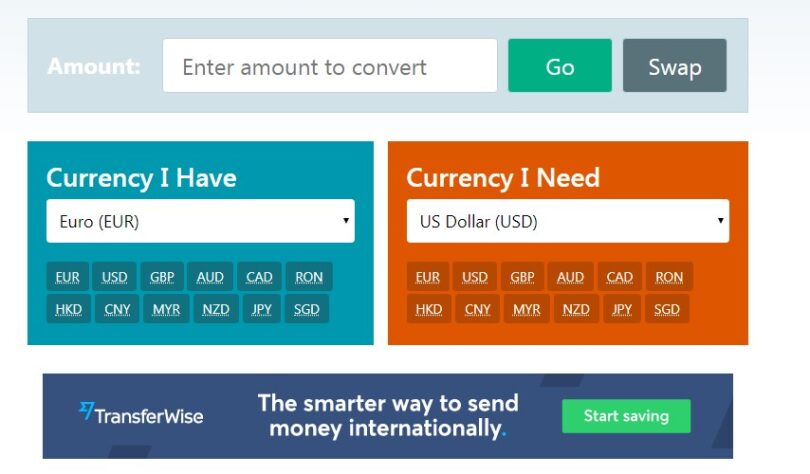

It is recommended that you confirm real-time exchange rates on a trusted currency site such as Currency-Converter-Calculator.com

How Fast Will Transfers Process?

Again, you are going to find a lot of variation in the speed at which transfers are processed by various providers. Some of them offer near-instant transfers, while others are going to require up to 72 hours or longer.

How Wide Is The Coverage?

While some money transfer providers have near-comprehensive coverage, others can only facilitate transfers between a dozen or so countries. So it is important to check that they serve your country (and your recipient’s country) before trying to make a currency transfer.

Is the Company Regulated And Trusted?

You should only ever remit funds with a trusted and regulated company. Otherwise, you are putting your funds at risk during transit. Taking a little extra time to verify that the company you plan to use is regulated and obeying the rules can prevent you from having a bad experience when transferring money.

What Are The Payment Options?

Some transfer companies allow you to fund transfers via a bank account, while others offer an array of payment options, including mobile payment apps and credit cards. On the receiver’s side, again, some only allow you to send funds directly to their bank account, while others offer cash pick-ups and several other options.

Are Sign-up Bonuses Available?

Look out for sign-up bonuses that some companies offer, such as discounted or waived transfer fees on your first few transfers.

A Quick Summary

- Sending money abroad is now easier than ever, with an abundance of options out there, including retail banks and dedicated international money transfer companies.

- You will find countless dedicated international money transfer and currency exchange companies competing for your business so take some time to compare them.

- High street banks are usually cheaper for larger transfers, as they charge a fixed fee, while m providers are typically more cost-effective for smaller transfers. Remember that cheaper doesn’t often mean better. Weigh the pros and cons of each transfer company you are considering.

- Dedicated companies are usually quicker at sending money abroad than banks, with some offering transfers in under 30 minutes.

- When considering which dedicated international money transfer company to remit with, you should consider an array of factors.

- Verify that the company you plan to use serves your country (and your recipient’s country) before trying to make a currency transfer.

- For example, you should consider their fees (both explicit and spread, if any), speed, regulation, coverage, trust, and the level of flexibility they offer.

- Some companies allow you to fund transfers via a bank account, while others offer an array of payment options, including mobile payment apps and credit cards. Choose the option that works best for both you and the person or business you are sending money to.

- Make sure the company you choose is under the authority of a regulatory body and is in compliance with its rules.

- Look for deals. Some companies offer discounts or waive fees on a few transactions.

Family Villa Holidays in Corfu: What Actually Matters for a Stress Free Stay

Family Villa Holidays in Corfu: What Actually Matters for a Stress Free Stay  Finding Solitude in the Wild Remote Camping in Undiscovered Gems Across 7 US States

Finding Solitude in the Wild Remote Camping in Undiscovered Gems Across 7 US States  Best Things To Do In Cyprus – Beaches, Nature, Boat Trips, Food, Culture, And Family Activities

Best Things To Do In Cyprus – Beaches, Nature, Boat Trips, Food, Culture, And Family Activities  A Complete Guide to Personalized Gift Ideas That Carry Real Thought and Value

A Complete Guide to Personalized Gift Ideas That Carry Real Thought and Value